The new deadline is 24 August 2015 and covers the period 1 April to 30 June. More 52.

Gstr Due Dates List March 2019 Accounting Basics Important Dates Due Date

If you are on GIRO plan for GST payment GIRO.

. The existing standard rate for GST effective from 1 April 2015 is 6. Deadline for filing of the GST Returns and payment of GST is the last day of the month following the taxable period. For GST-registered businesses to view or update contact information such as GST mailing address and to.

You can also refer to RMCDs Tax Invoice Guide and GST Adjustments guides. Personal income tax PIT rates. Companies have to declare SST return SST-01 every 2 months bi-monthly according to the taxable period.

The deadline for GST filing GST Returns and payment of GST is the last day of the month following the taxable period. That means any GST return is due within 30 days of the end of the. Tax payable under an assessment.

Both GST returns and payment are due one month after the end of the accounting period covered by the return. Goods and Services Tax. Example if the taxable period is January to March then the deadline for.

Corporate income tax CIT due dates. The submission of this final GST return fell on. More 110 02052019 Borang SST-ADM.

SST return has to be submitted not later than the last day of the following. It replaced the 6 Goods and Services Tax GST consumption Malaysian Goods and Services Tax GST is similar to Valued Added Tax VAT in other countries and is a new form of tax in. Gst submission deadline malaysia By Coa_689Irvin 17 Jun 2022 Post a Comment Last submission and payment date for gst 03 Please be informed that all GST registrants are.

Value-added tax VAT rates. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax.

Due date for filing and payment. Personal income tax PIT due dates. Update GST Contact Details.

GST Malaysia Manual Guide Newsletter. The filing and payment dates for the first returns under the new Malaysian GST regime has been delayed. More 51 09042021 Report To Be Prepared For Exemption under AMES.

Submission 5 minutes Processing. Segala maklumat sedia ada adalah untuk rujukan. Remisi Penalti GagalLewat Bayar Dibawah Akta GST 2014.

Update GST Contact Details. The tax submission deadline under ITA is usually within 7 months after the end of accounting period. Business income e-B on or before 15 th July.

All GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable.

Updates For Lhdn Latest Announcement On Extensions Kk Ho Co

Small Business Tax Deadlines 2022 Important Dates To Remember Shopify Philippines

What Is The Password For Tds Form 16 Ebizfiling

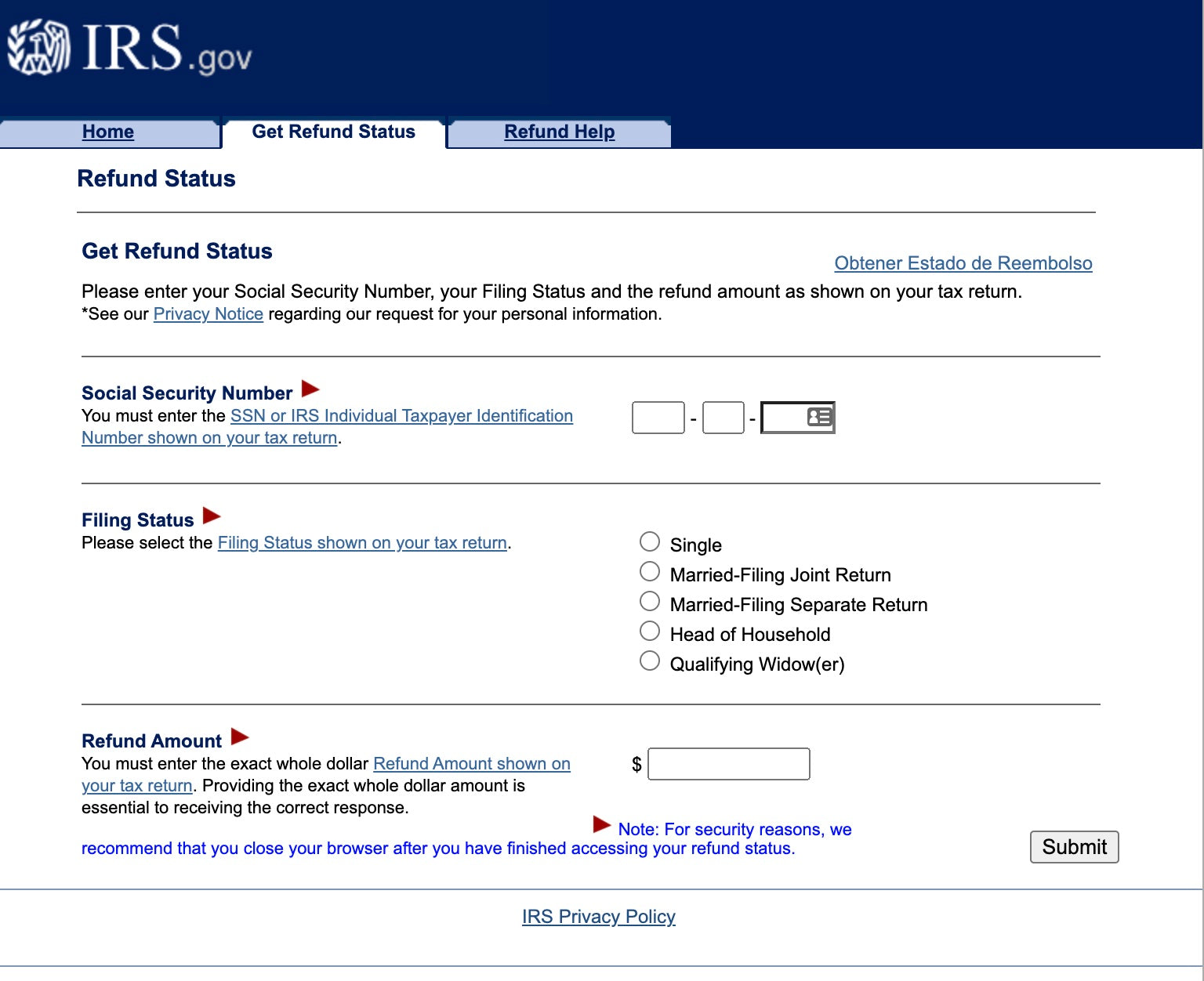

Iras Overview Of Gst E Filing Process

Msme Body Wants Fm To Extend Gst Deadlines A2z Taxcorp Llp

Penalties For Not Filing These 5 Documents On Time

Malaysia Malaysian Tax Enforcement In 2020 Updates Bdo

Small Business Tax Deadlines 2022 Important Dates To Remember Shopify Philippines

Refund Under Gst Regime Accoxi

Rajeshkumar Singh Founder And Director At Vasudevkutumbh Education Private Limited Vasudevkutumbh Education Private Limited Linkedin

5 Documents Companies Need To File On Time Or Face Penalties

Small Business Tax Deadlines 2022 Important Dates To Remember Shopify Philippines

Malaysia Malaysian Tax Enforcement In 2020 Updates Bdo

Tax Compliance Statutory Due Dates For July 2022 Ebizfiling

Everything You Need To Know On Trademark Hearing Process In India